According to CB Insights 2021 State of Venture Report, venture capital investments reached a record high of more than $600 billion last year. And venture capital investors didn't just make more investments in 2021 than they did in 2020; they also gave each recipient more capital. But not every industry received equal funding. Financial technology companies raised more than $130 billion in financial investments --- more than any other industry. This means that now is an excellent time to set your business apart by learning how to build a fintech app.

1. Determine What Type of Fintech App You'll Build

Financial technology encompasses a wide range of applications. The type of app you build will impact every aspect of the project, from who leads development to the features and interface users interact with. So, it's important to understand what the different fintech categories are and what it takes to build each type of app.

-

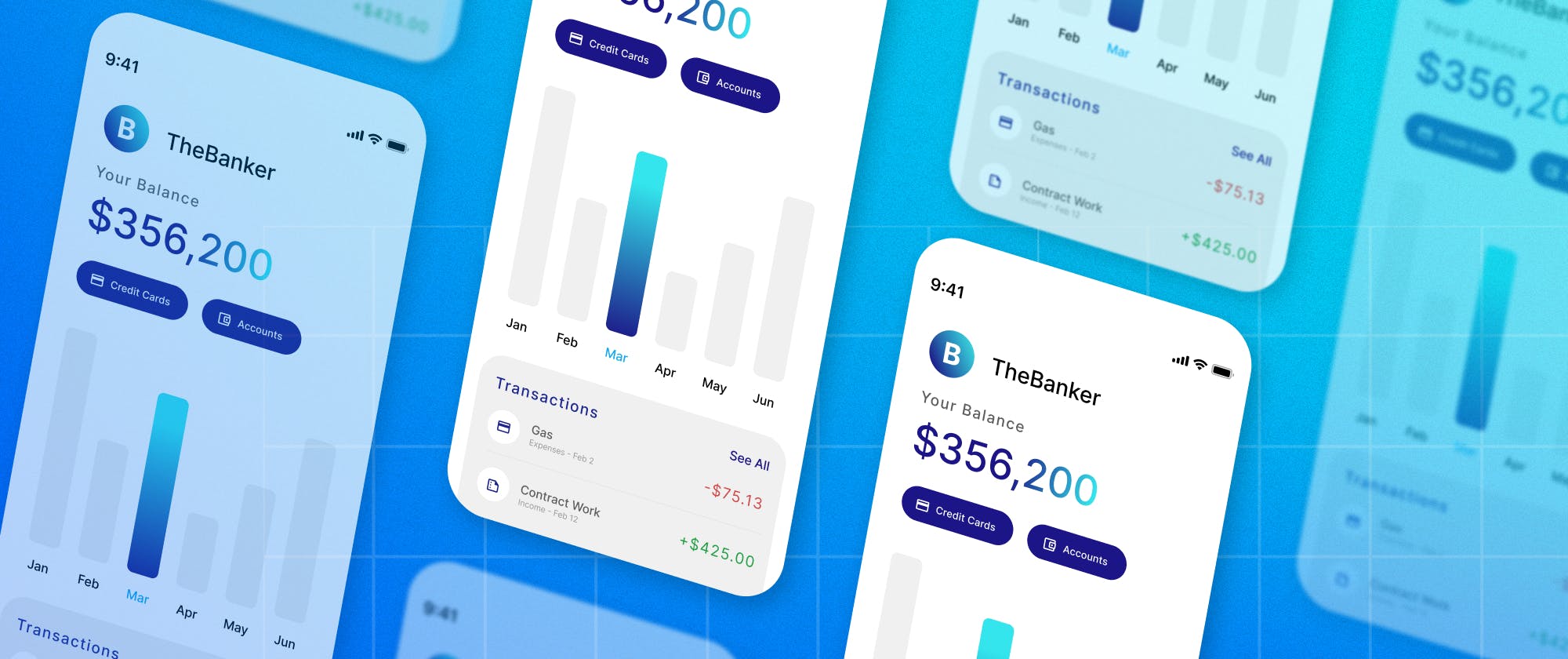

Personal banking and insurance apps are two of the most expensive, complex, and time-consuming apps to develop. They require two different interfaces that serve different functions: one for administrators to gain visibility into customer accounts and another for customers to access and make changes to their private accounts.

-

Lending apps are less expensive to develop than other consumer-facing apps. However, they do require interactive loan applications, which can be difficult to develop securely.

-

Investment apps are typically designed to display only information that guides consumer investment and to allow for basic investment actions, like buying and trading stocks. Because of this, it's possible to buy APIs that make the app easier and cheaper to develop than other apps.

2. Conduct Market Research

Heading into 2023, fintech startups are in a good position to apply for funding and invest in building new apps or developing existing ones. But the threat of an economic downturn still looms large over VC investors. To help mitigate their own risks, they'll be paying close attention to greater industry trends to guide how they invest. And if you want to secure financing and set yourself up for long-term success, you'll need to do the same. Researching the industry will help you understand what type of app will be a good market fit by giving you insight into what's currently available and what consumers want.

Successful products fill gaps in the marketplace and meet customer needs. But in finance, consumer needs and industry trends are in constant flux, which means you'll need to understand current and future market conditions to develop a successful app.

Conduct your own market research by checking for recent articles from industry publications to keep up with changing trends and help identify current gaps in the market. To stand out from other fintech apps, you'll also need to audit your competitors to see what their apps currently offer. Pay careful attention to app features and read user reviews to understand what pain points they have so you can deliver a more competitive product.

3. Build Customer Personas

User personas help your development team understand who the real-world users will be, including what their goals are and how they'll use the app. Building personas might seem like a basic step, but fintech companies miss the mark more often than you might think. Only around 25% of consumers believe that financial services brands deliver the experience that they want. If you want your app to attract and retain users, you need to take time to research your audience and build personas that help you and your development team empathize with users.

To build the best personas, start by collecting data about your user base to help you develop personas that represent your actual users rather than relying on guesses. Then, identify the different types of users, label roles, and clearly define user goals. Good personas list details, like a name and photo, to help you visualize the real-world individuals they represent. They also include information such as why the user accesses the app and what their common frustrations are. For instance, a payment processing app can identify ecommerce business owners and their customers' two primary user types.

4. Set a Budget

App development can cost anywhere from $50,000-$300,000, which means building a fintech app isn't cheap. And where your project will fall within this incredibly wide price range depends heavily on the type of app you build and its complexity. Hiring a development agency or an in-house team with the expertise required to build advanced features will be expensive, but in many cases, it's necessary.

Just consider the implications of hiring an inexperienced developer to handle your app's security: even a simple mistake can leave your app's users at risk of a security breach. And since 65% of consumers say security is the most important factor they consider when they evaluate banks and financial institutions, fintech apps can't afford to cut corners when it comes to security.

5. Map Out User Scenarios and Plan the User Experience

According to recent research, almost 70% of users abandoned a fintech app in 2021 --- and one of the leading causes for app abandonment was onboarding. Mapping out your app's user scenarios in advance will help you design an intuitive layout that helps you improve customer education and retain users.

Start by using the personas you created to identify user objectives and then outline the steps each persona will take to reach their goals. Then create visual representations of the different ways each persona interacts with the app. And by evaluating how the process works from the user's perspective, you can design a user experience that helps you set your app apart from the competition.

Take a look at how investment app Fisdom simplifies the traditional app user experience. Traditional investment app users are in the driver's seat of their investments, making decisions based on their own research, analyses, and educated guesses. Fisdom sets itself apart by using historical data and machine learning to offer advice that simplifies the investment process. Rather than researching and monitoring stock prices, users set investment goals and review Fisdom's suggestions. Then they can improve the plan and begin investing or decline the suggestions and let Fisdom try again.

6. Define App Features and Requirements

Defining the minimum viable product requirements will help you understand what features you need to prioritize to ensure your app meets customer needs. The specific product requirements will depend on the type of app you're building, your customers, and how they'll use the app. These factors will influence a variety of details, including the color of its interface to the amount of storage space it requires on a user's device. But regardless of the specific app you build, most fintech systems have a few of the same basic feature and capability requirements:

To ensure all of your potential customers can use your app, it's also a good idea to develop versions for both iOS and Android operating systems.

7. Select a Tech Stack

Your tech stack includes the programming language, tools, and frameworks that will be used to build your app. You'll need to consider what you'll use for each element ahead of time to ensure that your tech stack can do everything you need it to.

-

Programming Language: Python and JavaScript are the two most popular programming languages. While JavaScript is easier to use, Python allows for more complex development and is a better option for building a fintech app.

-

Framework: You'll need front- and back-end frameworks for both mobile and web development. And you'll need to choose frameworks that are compatible with your chosen programming language and match your development skill set.

-

Database: Relational and ledger databases are the most common types of databases for fintech apps.

-

Fintech APIs: Using APIs can streamline your build process more than relying on your internal development knowledge alone. For instance, APIs can help you enhance features like payment processing, stock trading, and chat support.

The best tech stack for your app will depend on your skill set and the type of app you're building. Look to other fintech companies and competitors to get an idea of what tools you should include in your stack.

8. Develop a Launch Strategy

Developing a launch timeline before you finish building your app will give you ample time to triple-check that your app ticks all of the relevant regulatory boxes. And if it doesn't, you'll still be able to tie up any loose ends to guarantee compliance with industry and legal requirements without delaying the launch.

For instance, to build a personal finance app, you'll need a banking license before any app users can make deposits, withdrawals, or transfer funds. But licensing agencies often move slowly, and there's no guarantee you'll receive the license you apply for. So, you'll need to work on getting the right license before you ramp up for the launch.

Once you've finished development, planning a soft launch for your fintech app will set you up for success by enabling you to make improvements that help drive product adoption. Soft launches give you an opportunity to test for bugs, collect data to improve your marketing spend, and make improvements that drive app downloads.

Simplify and Improve App Development With Fintech APIs

A fintech app build is a complex process that requires you to develop a variety of functionalities and capabilities in a strictly regulated space. Relying on fintech APIs allows you to simplify the process and provide a better user experience by giving you the tools to develop the best possible app. For example, chat APIs allow you to lean on conversational banking tactics to improve the user experience by offering easy-to-access live support when customers need it.

Start your free trial to see for yourself how Stream can help you improve your user experience.